What Dental Insurance Covers in 2025 But Doesn’t Tell: Complete Guide on Dental Insurance Preventive Coverage India

Did you know that nearly 67% of Indian families with dental insurance don’t fully utilize their preventive care benefits? What a missed opportunity! Dr Taniya Gupta, a Dental Surgeon and Mr Amit Gupta, an experienced Senior Bank Officer have analyzed dental insurance policies for years, and are constantly surprised by how many families leave money on the table.

As dental costs continue to rise in 2025, understanding dental insurance preventive coverage India, exactly what preventive care your dental insurance covers has never been more important. Whether you’re evaluating a new policy or trying to maximize your current coverage, this comprehensive guide will help you navigate the often confusing world of dental insurance preventive benefits in India. Get ready to unlock savings you didn’t even know existed!

Understanding Dental Insurance in India: The Basics

Let’s face it – dental insurance in India can be downright confusing! Unlike general health insurance that most Indians are familiar with, dental insurance coverage works quite differently. During my 14 years in banking and financial planning, I’ve analyzed countless dental policies, and the structure often catches families off guard.

Also refer: How to Create a Complete Preventive Dental Care Plan for Your Family in 2025

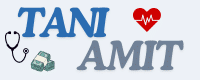

In 2025, the dental insurance market in India has expanded significantly, with major players like Star Health, HDFC ERGO, and Religare offering various forms of dental coverage. Most commonly, you’ll encounter dental benefits as:

- Standalone dental insurance plans (less common but more comprehensive)

- Rider benefits attached to your primary health insurance

- Limited dental coverage within comprehensive health plans

- Corporate dental benefits through employer health schemes

One challenge I frequently see families struggle with is understanding basic dental insurance terminology. Terms like “annual maximums,” “waiting periods,” and “covered percentages” often cause confusion. For instance, when a policy says it covers “100% of preventive care,” it usually means 100% of what the insurance company considers reasonable costs, not necessarily your dentist’s actual fees.

Most dental insurance plans in India implement waiting periods that significantly impact your access to preventive care. While basic preventive treatments like routine check-ups might be available immediately, other preventive procedures could have waiting periods of 3-6 months. Understanding these timing restrictions is crucial for planning your family’s dental care calendar.

Common Preventive Dental Treatments Covered by Indian Insurance

When analyzing dental insurance preventive coverage, it’s important to understand exactly which treatments fall under this category. Most standard dental insurance plans in India cover these basic preventive treatments:

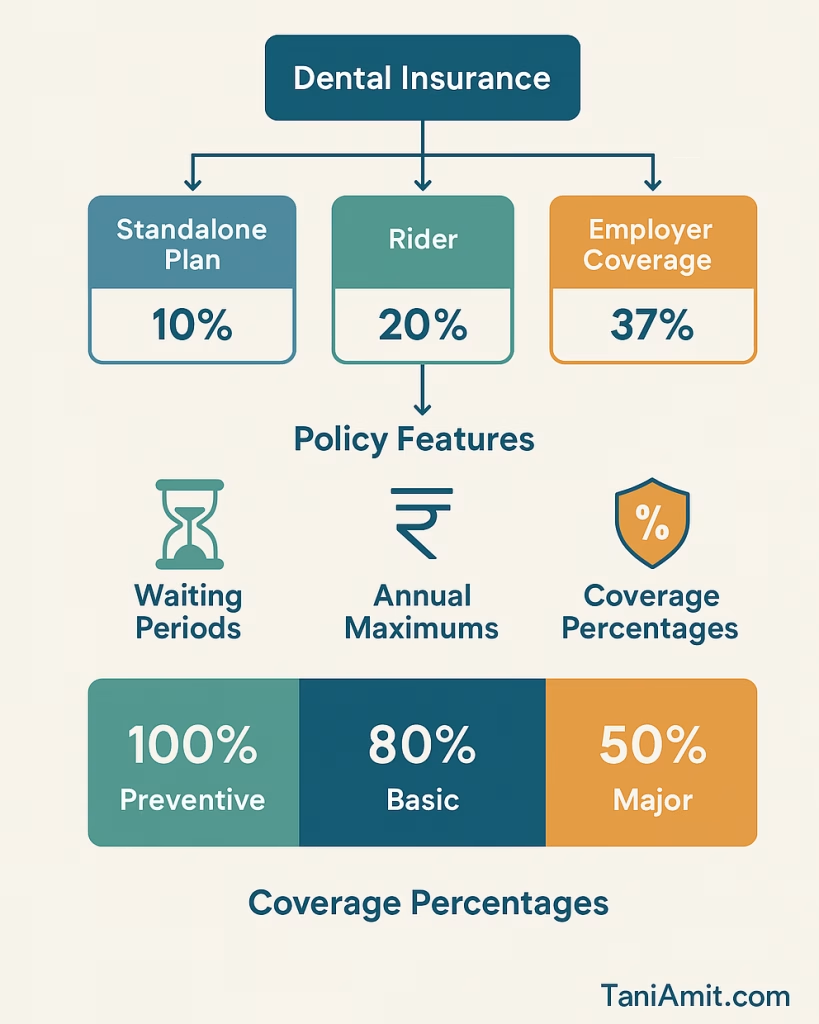

Routine Dental Check-ups and Examinations

Nearly all dental insurance policies cover periodic oral evaluations, typically twice per year. However, I’ve noticed significant variations in how frequently these are covered. Some budget plans limit coverage to just once annually, while premium family plans may cover quarterly check-ups for children.

The coverage frequency for routine dental check-ups directly impacts your family’s preventive care strategy. Most standard policies allow for evaluations every six months, which aligns with general dental recommendations. Premium family plans may offer more frequent coverage for children or members with specific dental conditions.

Professional Dental Cleaning (Scaling/Polishing)

Professional cleaning (scaling and polishing) is typically covered twice yearly under most dental insurance plans in India. This preventive treatment removes plaque and tartar buildup that regular brushing can’t address, helping prevent gum disease and cavities.

Coverage limitations often apply based on time intervals rather than calendar years. For example, your policy might specify that cleanings must be at least 6 months apart rather than simply allowing two per year. This subtle distinction can affect when you schedule appointments.

Diagnostic X-rays

Dental x-ray insurance coverage varies significantly between policies. Most plans cover:

- Bitewing x-rays once or twice yearly

- Full-mouth x-rays once every 3-5 years

- Panoramic x-rays once every 3-5 years

The frequency limitations for dental x-ray coverage reflect standard preventive care protocols. However, if your dentist recommends more frequent imaging for monitoring specific conditions, these may not fall under preventive coverage.

Fluoride Treatments

Fluoride treatment insurance coverage typically focuses on children, with most policies covering application 1-2 times yearly for members under 18. Adult fluoride treatments are less commonly covered as preventive care, though some premium plans now include this benefit for all ages.

Dental Sealants

Dental sealants insurance coverage is predominantly designed for children, typically covering application on permanent molars for members under 14. Coverage is usually limited to once per tooth over a specified period (often 3-5 years).

Hidden Preventive Benefits You Might Be Missing

During my years helping families optimize their dental finances, I’ve discovered that many insurance policies include valuable preventive benefits that most policyholders never utilize. These hidden gems can significantly reduce your out-of-pocket expenses!

One often-overlooked benefit is preventive orthodontic screenings for children. Many family dental plans cover these evaluations once or twice yearly for members under 18, potentially saving you ₹2,000-3,000 per visit. These screenings can identify issues early, potentially reducing the need for extensive orthodontic treatment later.

Another frequently missed benefit is special preventive coverage for pregnancy. Several major insurance providers now include additional cleanings and periodontal evaluations for expectant mothers, recognizing the connection between oral health and pregnancy outcomes. If you or a family member is pregnant, check your policy for these special provisions that might not be prominently featured.

Digital dental monitoring benefits are also emerging in premium insurance plans, with some covering remote assessment technologies that allow dentists to track oral health between office visits. This cutting-edge preventive approach can catch problems earlier while reducing the number of in-person visits needed.

Pre-treatment evaluations for complex procedures sometimes qualify as preventive care rather than being categorized with the treatment itself. This classification distinction can save you from paying higher co-insurance rates or reaching your annual maximum more quickly.

Coverage Limitations and Exclusions to Watch For

When reviewing dental insurance preventive care coverage, it’s critical to understand the limitations that might restrict your benefits. I’ve seen countless families surprised by denied claims simply because they didn’t understand these restrictions.

Most dental insurance policies implement annual preventive care coverage caps, typically ranging from ₹5,000 to ₹15,000 per member. Once you reach this limit, additional preventive treatments become out-of-pocket expenses, regardless of how necessary they might be.

Network restrictions present another significant limitation. While some policies offer the same preventive coverage for any licensed dentist, many implement substantial reductions in coverage (sometimes 30-50%) when you visit out-of-network providers. Always verify whether your preferred dentist participates in your insurance network before scheduling preventive care.

Procedure frequency limitations often catch policyholders by surprise. For example, your insurance might cover dental cleanings twice yearly, but require they be performed at least 6 months apart rather than within a calendar year. This subtle distinction means you can’t schedule both cleanings in close succession.

Age-specific exclusions are particularly important for family dental plans. For instance, fluoride treatments and dental sealants are typically covered only for children under specific ages (often 14-18), while adult preventive benefits might have different limitations.

Documentation requirements represent another common pitfall. Some insurers require detailed charting or specific diagnostic codes to qualify treatments as preventive. Working with a dentist familiar with insurance billing procedures can significantly improve your claims experience.

Perhaps most frustrating are “preventive” treatments that insurance companies surprisingly classify as basic or major procedures. Common examples include:

- Deep cleanings (scaling and root planing)

- Certain types of diagnostic x-rays

- Some preventive periodontal treatments

- Oral hygiene instruction sessions (often not covered at all)

How to Verify Your Specific Preventive Coverage

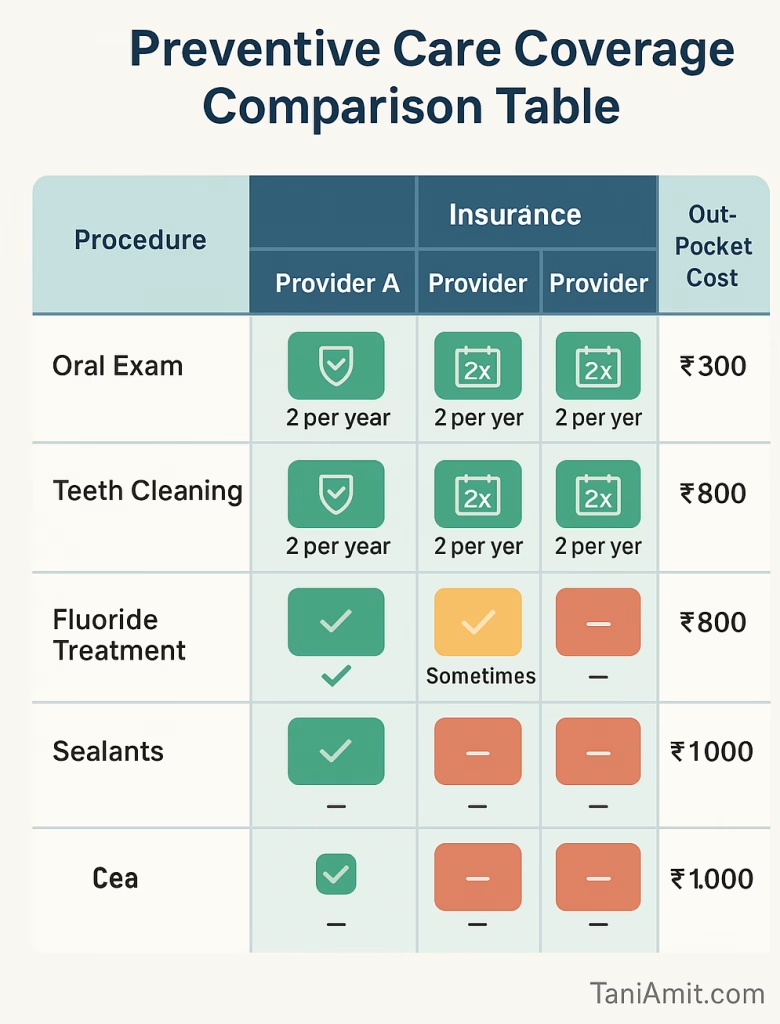

After helping numerous families navigate their dental insurance benefits, I’ve developed a systematic approach to verify preventive coverage:

- Obtain your complete policy documents (not just the summary of benefits)

- Locate the specific section on preventive/diagnostic coverage

- Create a list of standard preventive treatments your family needs

- Call your insurance provider with specific procedure codes to verify coverage

- Document the representative’s name, date, and details provided

- Request written confirmation of coverage for your records

When speaking with your insurance provider about preventive benefits, ask these specific questions:

- “What preventive treatments are covered for each age group in my family?”

- “Are there frequency limitations for specific preventive procedures?”

- “Do preventive treatments count toward my annual maximum?”

- “Are there specific documentation requirements for preventive care claims?”

- “Which preventive treatments require pre-authorization?”

Most major insurance providers now offer online portals or apps where you can verify coverage details. However, I’ve found these digital tools sometimes provide incomplete information about preventive benefits. Always cross-reference digital information with your written policy documents.

The pre-authorization process for borderline preventive procedures can save you from unexpected expenses. Treatments like fluoride varnish for adults or additional cleanings for specific health conditions may require pre-authorization to qualify as preventive care. This simple step can mean the difference between full coverage and significant out-of-pocket costs.

Maximizing Your Preventive Dental Insurance Benefits

Strategic planning can help your family extract maximum value from your dental insurance preventive benefits. Based on my experience optimizing dental finances, here are practical approaches:

Creating a family preventive care calendar based on your coverage limits is essential. Map out exactly when each family member should schedule preventive visits to maximize coverage while maintaining optimal oral health. For example, if your insurance covers two cleanings annually with at least six months between visits, schedule these strategically in January and July.

Coordinating benefits becomes crucial if multiple family members have different insurance plans. In some cases, you can utilize secondary insurance to cover costs not paid by your primary plan, potentially eliminating out-of-pocket expenses for preventive care entirely.

Timing strategies for scheduling preventive care can dramatically impact your coverage. For example, scheduling children’s preventive visits during school holidays when appointment availability is limited might mean compromising on provider networks. Instead, book these appointments well in advance with in-network providers to ensure maximum coverage.

Digital tools have revolutionized how families track and optimize their preventive care benefits. Apps like “DentalPlanner” and “InsurTrack” can send reminders when family members are due for covered preventive treatments and help you track remaining benefits throughout the year.

Cost Analysis: Uncovered Preventive Care vs. Future Treatments

The financial mathematics of dental care is clear: preventive care is substantially more affordable than restorative treatments. Let me share some concrete numbers that demonstrate why paying out-of-pocket for uncovered preventive care often makes financial sense.

Consider a typical scenario: Your insurance doesn’t cover adult fluoride treatments, which cost approximately ₹800-1,200 per application. However, this simple preventive measure can reduce cavity formation by 20-40%. Given that a single filling costs ₹2,500-5,000, the preventive investment delivers significant returns even if paid entirely out-of-pocket.

Similarly, dental sealants (₹1,000-1,500 per tooth) not covered for older teens might seem expensive initially. However, this one-time expense provides protection for 5-10 years. Compare this to the cost of a single molar restoration (₹5,000-8,000) or root canal treatment (₹12,000-25,000), and the preventive economics become compelling.

I’ve worked with families to calculate their potential savings from fully utilizing preventive benefits. For a family of four, maximizing all covered preventive treatments typically saves ₹30,000-50,000 annually compared to families who only seek dental care when problems arise.

Warning signs that skipping uncovered preventive care will lead to higher costs include:

- Family history of dental problems

- Previous restorative treatments needed

- Inconsistent home care routines

- Special conditions like pregnancy or diabetes

- Orthodontic appliances that complicate cleaning

Creating a budget for essential preventive treatments not covered by insurance represents a prudent financial strategy. I recommend families allocate 2-3% of their healthcare budget specifically for uncovered preventive dental care as an investment in future oral health.

TaniAmit’s Dental Insurance Preventive Care Checklist

To help you navigate your preventive benefits effectively, we have developed this comprehensive checklist based on years of analyzing dental insurance policies:

Annual Benefit Verification

- Request complete policy documentation specifically for preventive coverage

- Verify coverage frequency for each preventive service

- Confirm network restrictions for preventive treatments

- Identify age-specific preventive benefits for each family member

- Document any special circumstances qualifying for additional preventive care

Dental Provider Communication

- Provide your dentist with current insurance information before appointments

- Request preventive treatment plans with specific procedure codes

- Ask which preventive services might not be covered by your insurance

- Inquire about alternative preventive options if certain treatments aren’t covered

- Discuss optimal timing for preventive treatments based on your coverage

Record-Keeping System

- Create a dental insurance benefits folder (physical or digital)

- Maintain copies of all preventive care claims

- Document all communication with your insurance provider

- Keep receipts for all out-of-pocket preventive expenses

- Track annual benefit usage for each family member

This systematic approach ensures you maximize your preventive benefits while minimizing surprises and out-of-pocket expenses.

Conclusion

Navigating your family’s dental insurance preventive benefits doesn’t have to be overwhelming! By understanding exactly what’s covered, you can save thousands on both immediate out-of-pocket expenses and future restorative treatments. Remember, prevention is always more affordable than treatment!

Throughout this guide, we’ve explored the fundamentals of dental insurance in India, examined common preventive treatments covered, uncovered hidden benefits, identified important limitations, and provided practical strategies for maximizing your coverage.

Take action today by joining our newsletter and get our premium resources for free.

Have questions about your specific dental insurance coverage? Contact us, our experts can help you decode your policy and develop a personalized preventive dental economics strategy for your family.

Reach out to us for any question or content/copywriting needs.

Remember, understanding your dental insurance preventive coverage isn’t just about saving money today—it’s about investing in your family’s long-term oral health and financial wellbeing!