2025 Family Guide: Orthodontic Treatment Saving Plan India

Saving for Orthodontic Treatment: Financial Planning for Parents

Helping Indian families plan for their children’s braces and dental care

Do you want your child to have a healthy, confident smile? Braces and other orthodontic treatments can help, but they can be expensive. Don’t worry! With good planning, you can make this important investment without money stress. At TaniAmit, we combine dental knowledge with money-saving tips to help your family.

How Much Do Braces Cost in India?

The cost of braces and other orthodontic treatments depends on several things:

- Type of braces: Metal braces cost about ₹30,000 to ₹60,000. Clear braces cost about ₹40,000 to ₹70,000. Invisible aligners like Invisalign can cost from ₹80,000 to ₹2,50,000.

- How long treatment takes: Most kids wear braces for 18-36 months. Longer treatments usually cost more.

- Where you live: Treatment in big cities like Mumbai, Delhi, and Bangalore can cost 20-30% more than in smaller cities.

- Doctor’s experience: More experienced orthodontists often charge more.

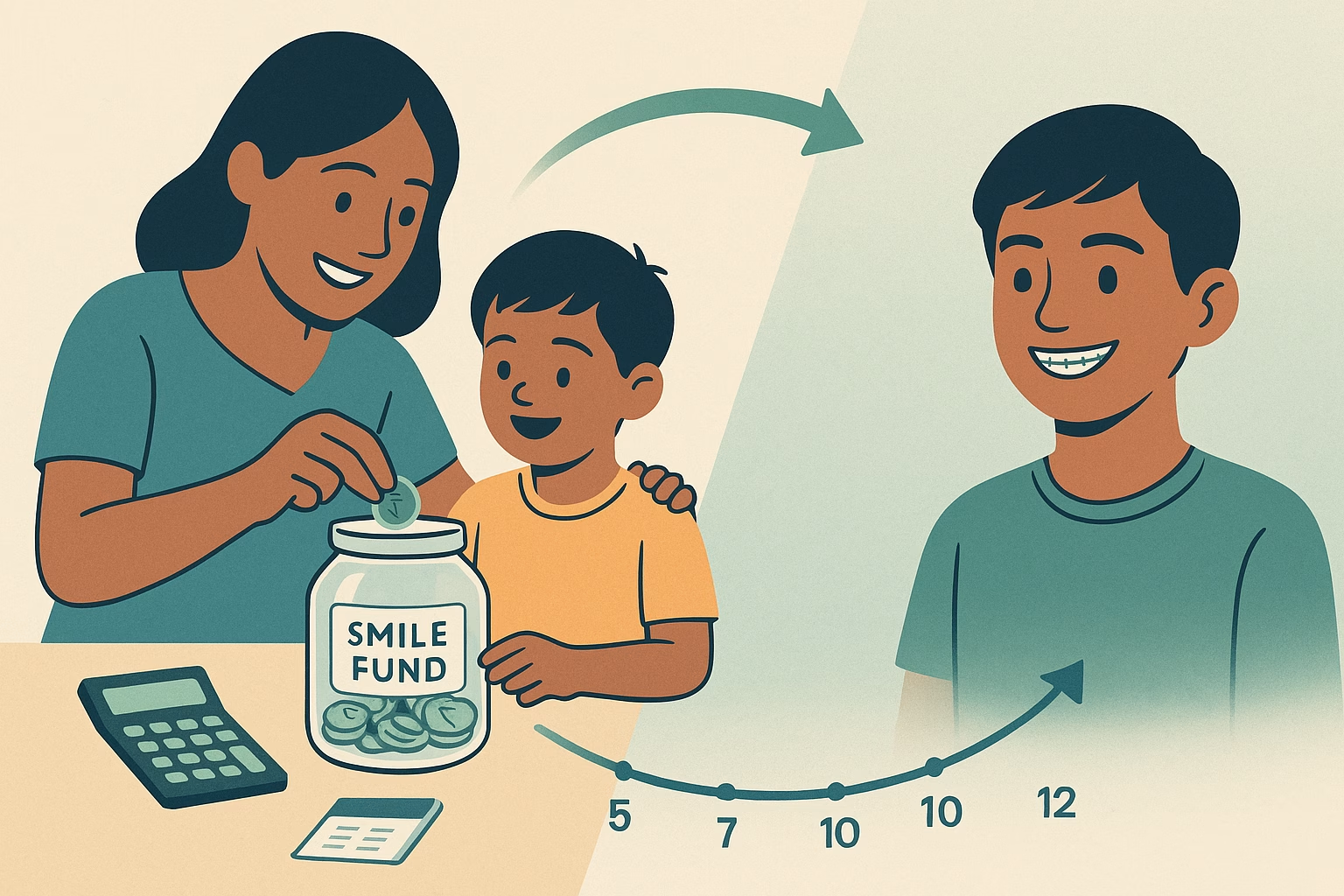

When Should You Start Saving?

The best time to start saving for your child’s braces is much earlier than most parents think!

Also Refer: How to Create a Complete Preventive Dental Care Plan for Your Family in 2025.

When Your Child is Very Young (Ages 2-5)

- Start a special “braces fund” when your child is still little

- Save small amounts of money regularly

- Even ₹500-1,000 per month adds up over time!

First Dental Check (Ages 6-7)

- Take your child to an orthodontist for a first check-up

- Ask how much treatment might cost in the future

- Adjust your savings plan based on what the doctor says

Before Treatment Starts (Ages 8-11)

- Get detailed treatment plans and costs

- Compare prices from 2-3 good orthodontists

- Save more money as treatment gets closer

Best Ways to Save Money for Orthodontic Treatment

Here are the best ways to save specifically for your child’s braces:

1. Recurring Deposits (RDs)

- Start with just ₹1,000 per month

- Earn fixed interest (currently 5.5-7%)

- Easy to withdraw when it’s time for braces

- Good for regular, disciplined saving

2. Systematic Investment Plans (SIPs)

- Might earn more money than regular deposits

- Start with ₹500-₹1,000 monthly

- Choose safe investment options for this goal

- Can withdraw when needed for treatment

3. Health Savings Accounts

- Special accounts for medical expenses

- May help reduce your taxes

- Can be used for dental procedures including braces

Does Insurance Cover Braces?

Understanding insurance is important for your planning:

Regular Health Insurance

Most regular health insurance in India does not cover braces because they’re considered cosmetic. However, there are exceptions:

- If braces are medically necessary (like for problems with biting or chewing)

- If your policy specifically includes dental coverage with orthodontic benefits

- If treatment is needed after an accident covered by insurance

Special Dental Insurance

- Not widely available in India yet

- Usually has waiting periods of 6-12 months

- May cover 20-50% of braces costs

- Check if the cost of insurance is worth the benefit

Tax Benefits You Can Get

You can save on taxes while saving for braces:

Section 80D Benefits

- Dental treatments may qualify under preventive health check-up rules

- You can get a tax deduction up to ₹5,000

- Keep all your receipts and bills!

Medical Insurance Premium Deductions

- If you pay for insurance that covers dental work, those payments can reduce your taxes

- Up to ₹25,000 for self and family (₹50,000 for senior citizens)

Payment Plans Offered by Orthodontists

Most orthodontists understand that braces are expensive and offer payment options:

Down Payment + Monthly Payments

- Typically: 40-50% upfront, rest paid monthly during treatment

- Often interest-free if arranged directly with the orthodontist

- Makes the cost more manageable for families

Discounts

- Some doctors offer 5-10% discounts if you pay the full amount upfront

- Family discounts when siblings get braces

- Special promotions (often in December-January)

Other Ways to Pay for Braces

If you haven’t saved enough, consider these options:

Health Credit Cards

- Special credit cards just for healthcare costs

- Many offer no-interest periods of 3-12 months

- Examples: Bajaj Finserv Health EMI Card and HDFC Health First

Personal Loans

- Interest rates usually between 10.5% to 16%

- Can be paid back over 1-5 years

- Easy to get if you have a regular job

Clinic Payment Plans

- Some big dental chains offer their own payment plans

- Ask about interest rates and compare with regular loans

- Sometimes these plans can be more flexible

One Big Payment or Monthly Payments: Which is Better?

Both have advantages depending on your situation:

Paying All at Once

- Often gets you a good discount (5-15%)

- No stress about monthly payments during treatment

- Protects you if prices go up

- Best if you already have the money saved

Monthly Payments

- Lower initial cost

- Fits better with most families’ monthly budgets

- Gives you time to save more during treatment

- Works better for most middle-income families

Our suggestion: A mix of both – make a bigger first payment (30-40%) and then comfortable monthly payments.

Less Expensive Treatment Options

If cost is a big concern, consider these alternatives:

Treatment in Phases

- Break treatment into important stages with breaks in between

- May take longer overall but spreads out the costs

- Fix the biggest problems first

- Can reduce costs by 15-30%

Limited Treatment

- Fixes only specific issues instead of everything

- Shorter treatment time (6-12 months)

- Costs 40-60% less than full treatment

- Good for minor problems or adults with specific concerns

Dental Schools

- Treatment by supervised dental students

- Save 30-50% compared to private clinics

- Appointments take longer and happen more often

- Quality is maintained through teacher supervision

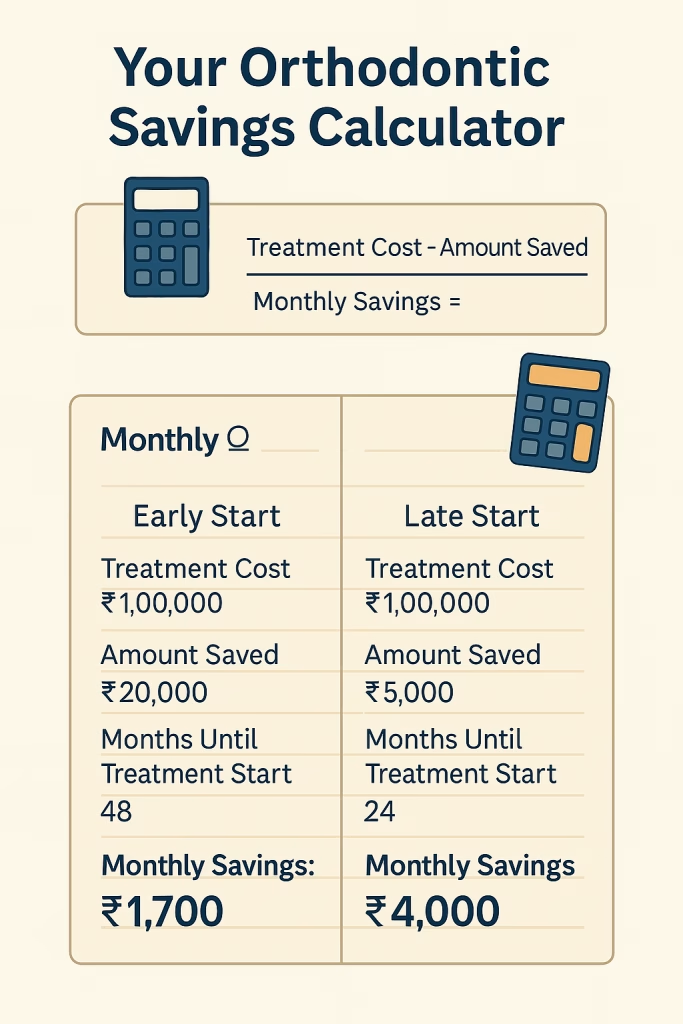

Making Your Own Braces Savings Plan

Follow these easy steps to create your savings plan:

- Find out costs: Research current braces prices in your city.

- Calculate time: How many months until your child will need braces?

Set monthly goal:

Monthly savings = (Total cost – Insurance coverage – Money you already have) ÷ Months until treatment

- Add extra: Save 10-15% more to cover unexpected costs or price increases.

- Choose how to save: Pick the savings method that works best for your timeframe.

- Check progress: Review your savings every three months and adjust if needed.

Real Family Examples

The Sharma Family Story

The Sharmas saved ₹2,000 every month in a recurring deposit starting when their daughter was 8 years old. By age 12, they had saved ₹1,20,000. With a discount for paying 40% upfront and a payment plan for the rest, they easily managed their daughter’s ₹85,000 braces without money stress.

The Mehta Family Story

The Mehtas found out their son needed braces right away, but they hadn’t saved specifically for this. They used their emergency fund for the first payment and got an 18-month payment plan for the rest. They managed, but the experience taught them to start planning early for their younger daughter.

Your Action Plan: Next Steps

Here’s how to start saving for your child’s braces today:

- Begin now: Start a special savings account as soon as possible.

- Visit an orthodontist early: Get a check-up by age 7 to understand potential costs.

- Set up automatic savings: Have money automatically moved to your braces fund on payday.

- Check insurance options: Look into dental insurance if you have enough time before treatment.

- Compare different doctors: Get treatment plans and prices from multiple good orthodontists.

- Use tax benefits: Structure your savings to pay less tax when possible.

- Keep some flexibility: Keep some money easily available in case treatment needs to start earlier.

Reach out to us for any question or content/copywriting needs.

Remember, investing in your child’s smile isn’t just about looks—it helps with overall health, confidence, and future success. With good planning, you can give your child a beautiful smile without hurting your family’s financial health.