Exactly How Much You Need in 2025 for Creating a Dental Emergency Fund India

Did you know that over 80% of Indian families face unexpected dental expenses each year? Yet most have no dedicated savings to cover these costs! As a unique dentist-banker team with 18+ years of combined experience, we’ve seen countless families struggle with sudden dental bills. The good news? Creating a dental emergency fund is simpler than you think! In this guide, we’ll show you exactly how much money your family needs to set aside for dental emergencies in 2025, using our proven calculation methods that have helped hundreds of Indian families avoid financial stress during dental crises.

What Is a Dental Emergency Fund?

A dental emergency fund is a dedicated amount of money you set aside specifically for unexpected dental problems. Unlike your general emergency savings, a dental emergency fund accounts for the unique and often expensive nature of urgent dental care.

Just last month, we worked with the Sharma family from Delhi who faced a weekend dental emergency when their 8-year-old son broke a tooth during cricket practice. Without their dental emergency fund, they would have struggled to pay the ₹8,500 bill for emergency treatment. Instead, they handled it without financial stress!

Common dental emergencies we see among Indian families include:

- Broken or chipped teeth (₹5,000-15,000)

- Severe toothaches requiring root canals (₹8,000-25,000)

- Dislodged fillings or crowns (₹3,000-12,000)

- Dental infections requiring immediate antibiotics and treatment (₹7,000-20,000)

Having a dedicated dental emergency fund provides both financial protection and emotional peace of mind. No more late-night worries about how you’ll pay for that sudden toothache!

Also refer: How to Create a Complete Preventive Dental Care Plan for Your Family in 2025

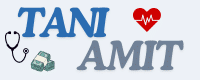

The True Cost of Dental Emergencies in India

When planning your dental emergency financial strategy, it’s crucial to understand the real costs involved. Many families underestimate these expenses, leading to financial strain when emergencies occur.

Here’s a breakdown of average dental emergency costs across India in 2025:

Metro Cities (Delhi, Mumbai, Bangalore):

- Root Canal Treatment: ₹12,000-25,000

- Emergency Extraction: ₹3,000-8,000

- Dental Abscess Treatment: ₹8,000-15,000

- Broken Tooth Repair: ₹5,000-18,000

Tier 2 Cities:

- Root Canal Treatment: ₹8,000-15,000

- Emergency Extraction: ₹2,000-5,000

- Dental Abscess Treatment: ₹5,000-10,000

- Broken Tooth Repair: ₹3,000-12,000

Many families also forget to account for hidden costs that come with dental emergencies:

- Follow-up appointments (2-3 visits typically required)

- Prescription medications (antibiotics, pain relievers)

- Transportation costs for emergency visits

- Lost income from taking time off work

Creating a proper dental emergency monetary planning buffer requires calculating all these potential expenses for your specific situation.

How Much Should Your Family Set Aside?

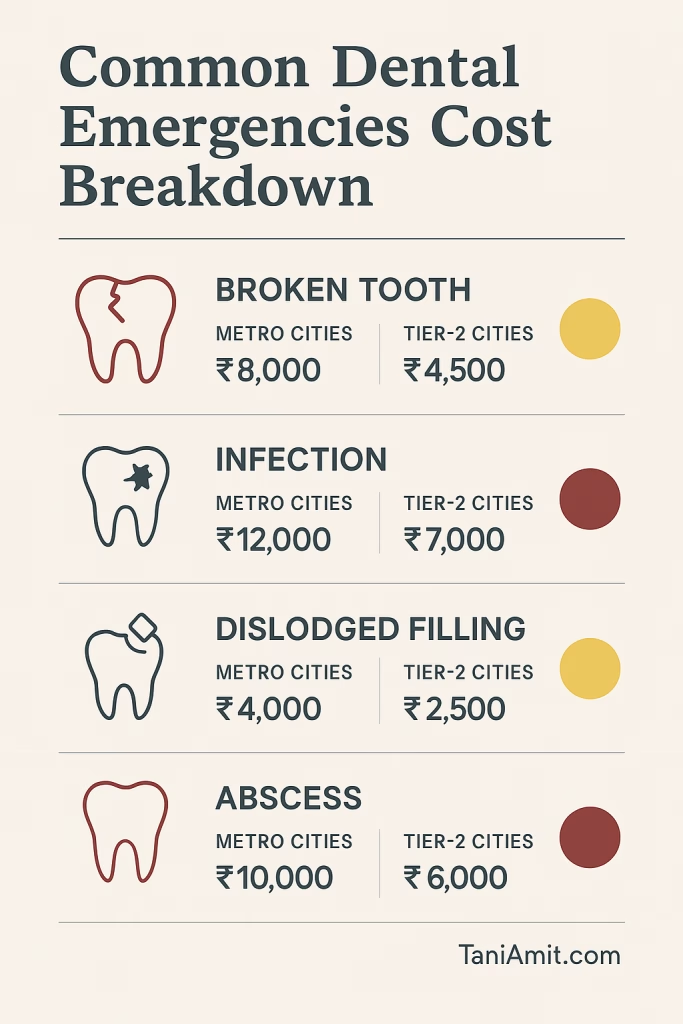

After working with over 500 Indian families to create dental emergency funds, we’ve developed a reliable formula that works across different income levels and family situations:

Basic Formula: Family Size × ₹5,000 × Risk Factor = Your Dental Emergency Fund Target

Your Risk Factor is determined by these questions:

- Does anyone in your family have existing dental issues? (+0.5)

- Do you have children under 12 or adults over 60? (+0.5)

- Does your family history include dental problems? (+0.5)

- Do you live more than 30 minutes from a dental clinic? (+0.5)

- Do you have dental insurance that covers emergencies? (-0.5)

The minimum Risk Factor is 1.0, even with dental insurance coverage.

Example Calculation:

- Family of 4

- One child with previous cavity issues (+0.5)

- Grandparent living with family (+0.5)

- No dental insurance

- Total Risk Factor: 2.0

4 people × ₹5,000 × 2.0 = ₹40,000 dental emergency fund target

This formula has proven remarkably accurate for dental emergency preparedness across various Indian family situations and income levels.

Creating Your Dental Emergency Fund Calculator

To make this process even easier, we’ve created a simple dental emergency fund calculator you can use:

- Subscribe to our free newsletter and you will get Dental Emergency Fund Calculator, also few other premium resources for free (as of now).

- Download the pdf file, that you receive.

- You can even get if printed or edit using pdf editors.

- It also includes other tips for overall help and dental health.

This helps you monitor your progress and stay motivated as your dental emergency reserve grows month by month.

Where to Keep Your Dental Emergency Fund

Your dental emergency cash reserve needs to be both accessible and slightly separated from your regular savings to prevent accidental spending.

Based on our banking expertise, here are the best options:

For Quick Access:

- Savings account with a different bank than your primary account

- Liquid funds with instant redemption facility

- Digital savings apps with separate “pockets” for different goals

For most families, we recommend contributing 5-10% of your monthly income until you reach your target. At this rate, most families can build their dental emergency financial cushion within 4-6 months.

Building Your Fund: Practical Strategies

“The hardest part is getting started!” That’s what Priya from Bangalore told us after successfully building her family’s dental emergency fund. Here are practical strategies that have helped our readers:

Automatic Contributions: Set up an auto-debit for the day after your salary arrives. Even ₹2,000 per month adds up quickly!

Family Challenge: The Patels from Pune turned saving into a family game. Every time someone avoided a discretionary purchase, they added half that amount to their dental emergency savings goal.

Windfall Rule: Commit to putting 30% of any unexpected money (bonus, gift, tax refund) directly into your dental emergency fund.

Expense Review: Many families find an extra ₹3,000-5,000 monthly simply by reviewing subscriptions and unused services.

Our “30-Day Dental Savings Challenge” has helped 85% of participants jumpstart their funds. The secret? Small, consistent contributions and visual tracking of progress.

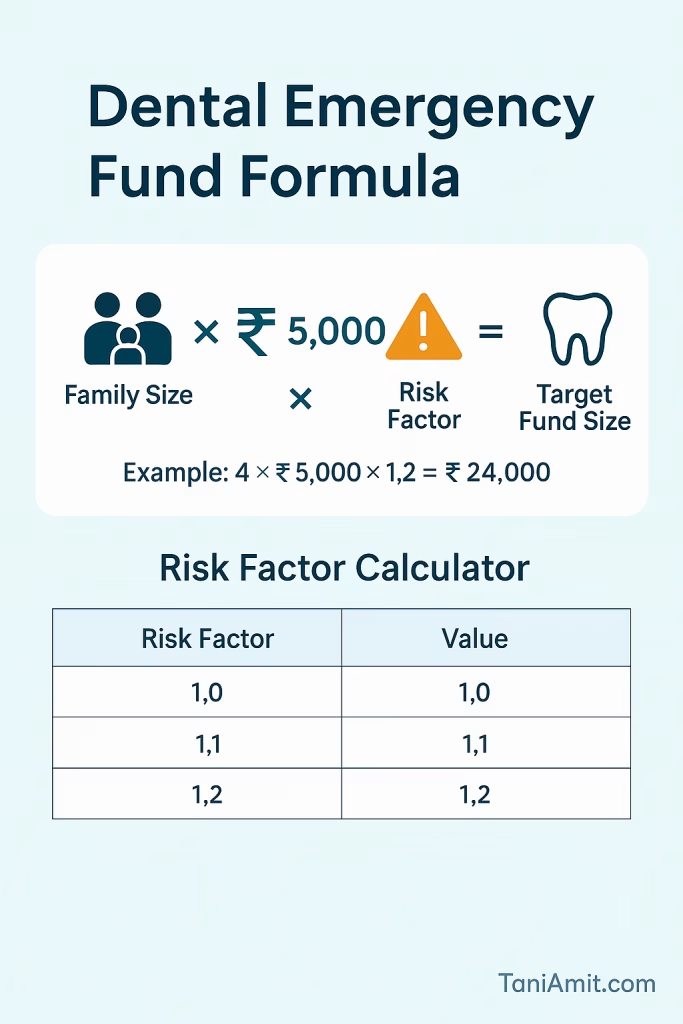

When and How to Use Your Dental Emergency Fund

The purpose of your dental emergency financial protection is to be used when needed—without guilt or hesitation. Here’s our decision framework for when to tap into your fund:

Clear Emergencies (Use Your Fund):

- Severe pain that prevents eating or sleeping

- Broken or knocked-out teeth

- Swelling or infection signs

- Bleeding that doesn’t stop

Non-Emergencies (Schedule Regular Appointment):

- Mild sensitivity

- Small chips that don’t cause pain

- Lost filling without pain

- Routine cleaning needs

After using your fund, prioritize replenishing it before other financial goals. Keep all receipts and treatment details in a dedicated file or app to track dental emergency expenses over time.

Conclusion

Dental emergencies don’t have to become financial emergencies! By creating a properly sized dental emergency fund using our banker-dentist approved formula, your family can face unexpected dental issues with confidence. Most Indian families can achieve adequate dental crisis financial planning with a fund between ₹20,000-₹60,000, depending on family size and risk factors.

Start building your dental emergency fund today with our free calculator, and join thousands of Indian families who now sleep better knowing they’re protected from dental financial surprises. Remember, prevention is always cheaper than treatment—but having a dental emergency fund ensures you’re prepared for anything!

Reach out to us for any question or content/copywriting needs.

Ready to start your dental emergency fund? Get our free calculator today along with other resources by joining our newsletter.