Dental Budget Secrets 2025: Creating a Family Dental Care Monthly Budget

Did you know that the average Indian family spends over ₹30,000 annually on unexpected dental treatments? That’s a significant chunk of your hard-earned money that could be better allocated with proper planning! Creating a family dental care monthly budget isn’t just financial discipline—it’s taking control of your family’s oral health while protecting your wallet.

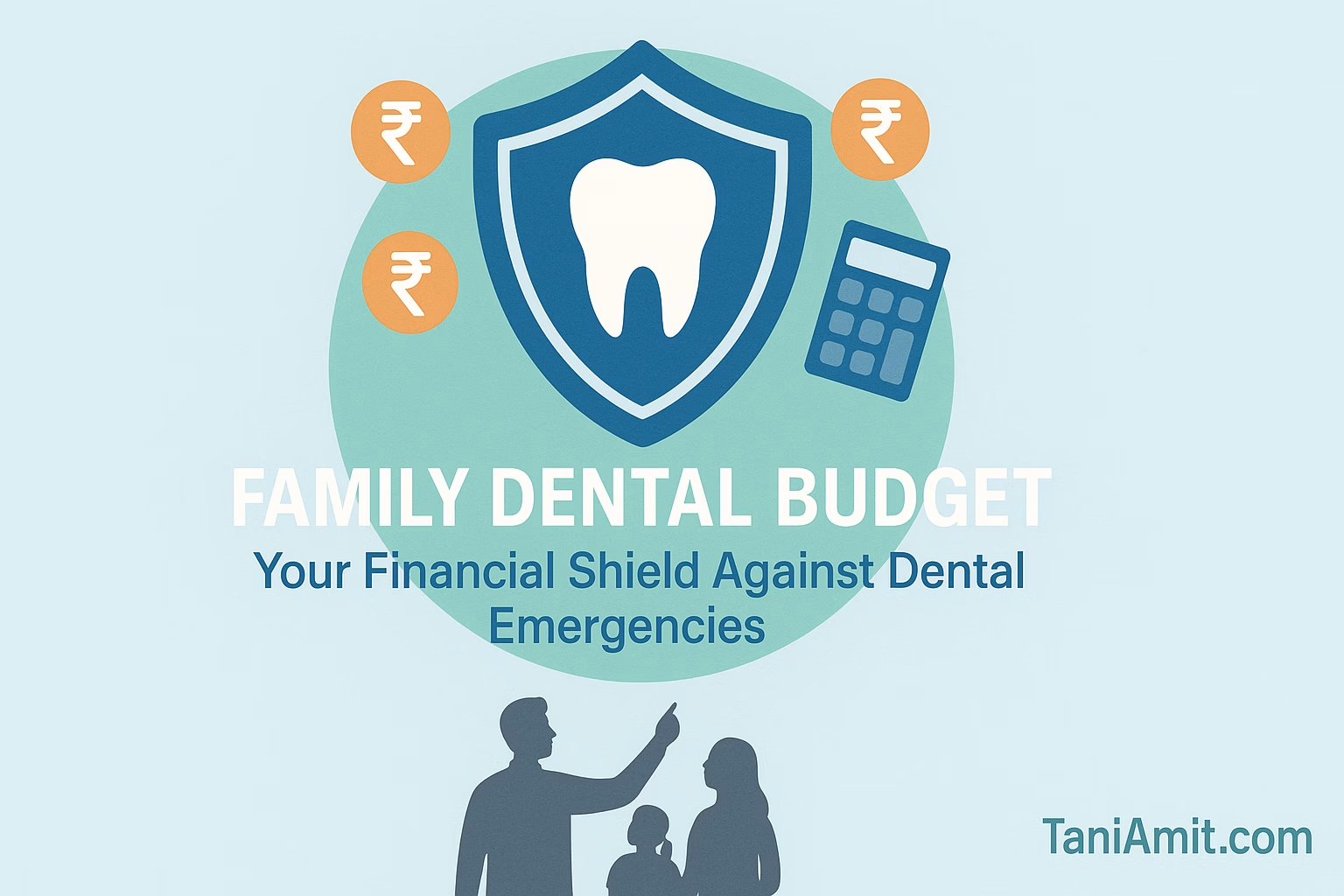

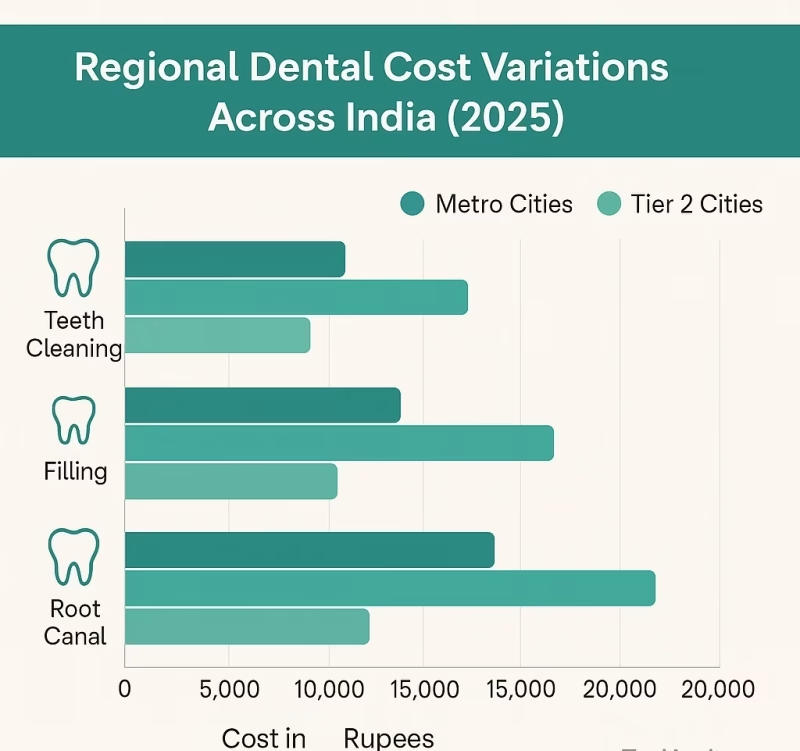

Quick Reference: Common Dental Costs in India (2025)

| Procedure | Metro Cities (₹) | Tier 2 Cities (₹) | Rural Areas (₹) |

| Routine Checkup | 800-1,500 | 600-1,200 | 400-800 |

| Deep Cleaning | 2,000-4,000 | 1,500-3,000 | 1,000-2,000 |

| Filling | 1,500-3,500 | 1,200-2,800 | 800-2,000 |

| Root Canal | 8,000-15,000 | 6,000-12,000 | 4,000-10,000 |

| Crown | 5,000-20,000 | 4,000-15,000 | 3,000-12,000 |

| Braces | 30,000-80,000 | 25,000-60,000 | 20,000-50,000 |

Why Every Indian Family Needs a Dental Care Budget

The financial impact of unplanned dental emergencies can devastate family finances. Just last year, my own family faced an unexpected root canal treatment that cost us ₹15,000—money we hadn’t budgeted for and had to pull from our vacation savings.

Also Refer: How to Create a Complete Preventive Dental Care Plan for Your Family in 2025.

The Prevention Advantage

- Preventive care costs 60-80% less than treatment for dental issues

- Regular checkups (₹800-1,500) prevent treatments costing ₹8,000-25,000

- Indian families save 40-60% on annual dental expenses through proper budgeting

Success Story: The Sharma family from Bangalore reduced their yearly dental expenses from ₹45,000 to just ₹18,000 by implementing a monthly oral healthcare budget strategy.

Quick Budget Calculator

For a family of four, estimate your monthly dental budget:

Monthly Preventive Budget = (Cost per checkup × 2 visits × family members) ÷ 12

Emergency Fund Contribution = Target fund size (₹15,000) ÷ Months to build fund

Supplies Budget = ₹250-400 per month

Example: Family of 4 with checkups at ₹1,500 each

- Monthly Preventive: (₹1,500 × 2 × 4) ÷ 12 = ₹1,000/month

- Emergency Fund: ₹15,000 ÷ 12 = ₹1,250/month (to build in 1 year)

- Supplies: ₹400/month

- Total Monthly Budget: ₹2,650

Assessing Your Family’s Current Dental Expenses

Before creating your budget, understand where your money is currently going:

- Gather Past Records

- Collect all dental receipts and insurance claims from the last 12-24 months

- Download our Dental Expense Tracker Template to organize this information

- Categorize Your Expenses

- Preventive care (cleanings, check-ups, X-rays)

- Treatments (fillings, crowns, root canals)

- Emergency procedures

- Products (toothbrushes, paste, floss, mouthwash)

- Calculate Your Baseline

- Monthly Average = Total Annual Dental Expenses ÷ 12

- Identify seasonal patterns (school holidays, year-end insurance periods)

Essential vs. Discretionary Dental Expenses

Must-Have Budget Components

- Bi-annual professional cleanings and check-ups

- Essential X-rays (typically every 1-2 years)

- Basic dental hygiene supplies

- Treatment of active decay or infection

Return on Investment

A ₹1,000 preventive cleaning can save ₹15,000 in cavity treatments—a 1,400% return!

Age-Specific Budget Considerations

| Family Member | Budget Priority | Approximate Cost |

| Young Children (0-12) | Preventive care, sealants | ₹3,000-5,000/year |

| Teens (13-19) | Preventive care, orthodontics | ₹5,000-50,000/year |

| Adults (20-60) | Preventive care, restorative work | ₹4,000-12,000/year |

| Seniors (60+) | Preventive care, dentures, implants | ₹6,000-30,000/year |

Dental Value Quotient: Long-term Health Benefit ÷ Current Cost Use this formula to prioritize different dental services in your budget.

Creating Your Monthly Family Dental Budget Framework

Step 1: Establish Core Budget Categories

<img src=”/api/placeholder/400/320″ alt=”Budget Allocation Pie Chart”>

Ideal Budget Allocation

- Preventive Care: 40-50%

- Emergency Fund: 20-30%

- Insurance Premiums: 0-20% (if applicable)

- Regular Supplies: 10-15%

- Special Needs/Treatment: Remaining %

Step 2: Calculate Monthly Allocations

Preventive Care

Monthly Preventive Budget = (Cost per visit × Visits per year × Family members) ÷ 12

Emergency Fund

- Start with ₹5,000

- Add ₹500-1,000 monthly until you reach ₹10,000-15,000

- Replenish after using for emergencies

Insurance Planning

- If insured: Include premium in monthly budget

- If uninsured: Allocate equivalent funds to self-insurance approach

Monthly Supplies

- Quality toothbrushes (replaced quarterly): ₹150-200/person/year

- Toothpaste, floss, mouthwash: ₹200-300/month for family of four

Family-Specific Budget Customization

For Families with Young Children

- Additional budget for pediatric dentist visits (₹500-1,000 more per visit)

- Preventive sealants (₹1,000-2,000 per child)

- Focus on education and habit formation

For Families with Teens Needing Orthodontics

- Create a dedicated orthodontic savings fund (₹2,000-5,000 monthly)

- Research payment plans (typically ₹5,000-10,000 initial + ₹2,000-4,000 monthly)

- Budget for additional hygiene products specific to braces

For Multi-generational Households

- Allocate higher percentages for senior dental care

- Consider specialized denture care products

- Plan for more frequent checkups for seniors and children

For Families Without Dental Insurance

- Increase emergency fund target (₹20,000-25,000)

- Research and budget for dental discount plans

- Allocate more for preventive care to avoid costly treatments

Smart Strategies to Reduce Monthly Dental Expenses

Preventive Focus

- Never skip routine check-ups and cleanings

- Budget for professional cleanings every 6 months

- Invest in quality electric toothbrushes and water flossers

Insurance Maximization

- Schedule optional procedures strategically to maximize benefits

- Use remaining benefits before year-end

- Consider dental discount plans as alternatives to traditional insurance

Cost-Effective Care Options

| Option | Potential Savings | Best For |

| Dental Schools | 30-50% | Routine care, basic treatments |

| Community Clinics | 20-40% | Preventive care, basic treatments |

| Government Hospitals | 40-60% | Complex treatments, surgeries |

| Dental Tourism (major cities) | 15-30% | Extensive work requiring multiple visits |

Payment Strategies

- Negotiate cash discounts (typically 5-15%)

- Establish interest-free payment plans for larger treatments

- Time major treatments with tax refunds or bonuses

Digital Tools for Budget Management

Recommended Apps for Indian Families

- Money Manager: Best for categorizing dental expenses

- ET Money: Excellent for tracking healthcare spending

Digital Organization System

- Set up automated savings transfers for dental funds

- Create digital calendar reminders for:

- Routine appointments (6-month intervals)

- Insurance claim deadlines

- Product replacement schedules

- Maintain cloud-based dental records using CareZone or Google Drive

Monthly Budget Implementation Timeline

| Month | Action |

| Month 1 | Set up budget categories and begin tracking expenses |

| Month 2-3 | Build initial emergency fund (₹5,000) |

| Month 4-6 | Schedule preventive appointments |

| Month 7-9 | Review and adjust budget based on actual expenses |

| Month 10-12 | Maximize insurance benefits (if applicable) |

| Annually | Conduct comprehensive budget review and adjustment |

Measuring Success and Adjusting Your Dental Budget

Key Performance Indicators

- Total dental spending compared to pre-budget baseline

- Percentage of emergency vs. planned dental expenses

- Preventive appointment compliance rate

- Growth rate of your dental emergency fund

Quarterly Review Process

- Compare actual vs. budgeted spending

- Identify patterns and anomalies

- Adjust allocations as needed

- Update savings goals based on upcoming needs

Success Story: The Verma family from Delhi reduced their dental emergencies by 80% and their total dental spending by 45% after implementing a structured budget.

Conclusion

Creating and maintaining a family dental care monthly budget is one of the smartest financial moves for your family’s health and wealth. By following this step-by-step approach, you’re creating a framework for better oral health outcomes while protecting your financial future.

Reach out to us for any question or content/copywriting needs.

Take action today by joining our newsletter and get our premium resources for free.